KYC & COD Guidelines

class="text-muted">Bigship - Official Policies

KYC (Know Your Customer)

KYC (Know Your Customer) is a critical aspect of all financial transactions, including those in logistics and courier aggregation. Logistic companies need their customers to comply with KYC to verify identities and ensure the safety and legality of products and sellers.

Once documents are uploaded, it's important to directly mail on security@bigship.inor else you can inform the Sales Point of Contact (POC) to proceed with KYC approval.

There are several benefits of completing KYC with courier aggregator companies. Primarily, it ensures transaction security and authenticity, which helps prevent fraud. Additionally, KYC enables faster and more seamless transactions since the verification process is pre-completed. In the logistics industry, it also fosters trust between companies and their customers, promoting long-term business relationships.

Types of the KYC’s

Documentation Required

- Aadhar card

- PAN card

- Cancelled cheque/bank statement/passbook

KYC Verification Process

The provided documents will be scrutinized for authenticity and compliance with the KYC requirements. Verification will be conducted by security team to ensure accuracy and completeness. If facing any issue while uploading documents you can always connect to your sales POC or security@bigship.inor client.service@bigship.in.

Service Limitation for Individual Sellers

- No LTL service will be activated for individual seller accounts.

- Individual sellers will be restricted to booking shipments in the B2C (Business to Customer) category only.

- Any changes in documentation or status must be promptly communicated to the POC.

Registration Process

Businesses registered under various categories such as Proprietorship, Partnership, HUF (Hindu Undivided Family), or Trust will undergo the business KYC process. The registration process will necessitate the submission of specific documents for verification.

Required Documents for KYC

- GST Certificate

- Aadhar Card (of proprietor/partners/directors)

- PAN Card (of proprietor/partners/directors)

- Cancelled Cheque (of the business proprietor/partners)

Proprietor Verification

All documents shared should match with the details of the proprietor mentioned in the GST certificate. It is imperative to ensure consistency and accuracy in the proprietor's information across all documents.

Partnership Firm Verification

In the case of a partnership firm, documents of any one director can be considered for KYC verification. The documents provided should align with the details mentioned in the GST certificate.

Registration Process

Companies registered under MCA (Ministry of Corporate Affairs) as Pvt. Ltd, LLP (Limited Liability Partnership), or Public Ltd will undergo the company KYC process. The registration process will require submission of specified documents for verification.

Required Documents for KYC

- GST Certificate

- Incorporation Certificate

- Aadhar Card (of directors)

- PAN Card (of directors)

- Cancelled Cheque (of the company/director)

All documents shared must match with the details of the directors of the firm. A cancelled cheque of the company or director is mandatory for this case. It serves as a means to verify the bank account details provided by the company for transactions.

It's important to note that COD remittance will not be processed if KYC details are incomplete or mismatched. KYC approval or rejection is based on the documents provided. While the KYC process can be challenging, customers can always reach out to their Sales POC for assistance. The Sales POC can offer guidance and help ensure successful KYC completion. Alternatively, assistance is available via email at- client.service@bigship.in, security@bigship.in

Important Notes

- In case of a suspended/ Cancelled GST, sellers should promptly inform the finance team or provide an updated GST Certificate to avoid LTL service deactivation.

- Please keep the photo(s)/ scanned copy of valid copy of KYC documents ready for upload. The name and address on the KYC document should match with the name and address on the panel.

COD Remittance

COD Remittance is the payment which is collected as COD from the consignee. The payment is processed directly to the seller’s bank account.

The COD Payment Cycle is mentioned below:

- Payment is processed after 7 Days from the DOD (Date of Delivery) on first Tuesday and Friday.

- COD Remittance for heavy shipments (LTL) is only processed on first Friday after completion of Delivery+7 days.

- COD Remittance processed on Tuesdays is for all the B2C shipments delivered till last Monday.

- COD Remittance processed on Fridays is for all the B2C & B2B shipments delivered till last Thursday.

- If seller wants to get his remittance held due to any reason; he should inform the finance department priory by mailing at finance@bigship.in

- Seller is required to fill correct bank details in the system; Bigship will not be liable for any wrong payments processed due to incorrect bank details mentioned by the sellers.

- In case payment is bounced by the bank due to any reason the same will processed once the correct bank details are updated.

COD Remittance hold

- COD Remittance can be held in case of negative wallet

- COD Remittance will be held in case of Incomplete KYC or if the uploaded documents are not readable format.

- COD Remittance can be held if any fraudulent activity is detected against the seller.

Sop Early Cod Remittance

Sellers need to apply for Early COD plan via panel only. Once we receive the request our executive will call you within 24-48hrs of the application for details. Once the details are filled the application will be reviewed and it may be approved or rejected by our finance team. Sellers will be informed via mail once the plan is Approved or Disapproved.

Sellers can also update their plans by applying from panel; it may take 24-48hrs to update your new plan till then COD Remittance will be processed as per the previous plan. Seller will start receiving Early COD after 24-48hrs of activation of the plan.

Seller can request for deactivation of the Early Cod plan via mail on finance@bigship.inthe plan will be deactivated within 24-48hrs of request; mean while the shipments delivered in that duration will be charged in early cod.

Bigship’s First Mile SOP’s

- For pickup we can only raise the escalation to the courier company only after 24 hours if the pickup is not done.

- Pickup request will be cancelled after 3 days if the shipment is not picked up.

- Raise any escalation for pickup to CS team after 24 hours if the shipment is not picked up.

- Please share the complete documents at the time of pickup for (e.g. Ewaybill/ Invoice)

E-WayBill

E-Way Bill is an Electronic Way bill for movement of goods to be generated on the e-Way Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50, 000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on www.ewaybillgst.gov.in.

E-Way Bill is mandatory for all those shipments whose actual value is more than Rs.50000/- to be transited in a single consignment, irrespective of the value declared by the Seller/Client.

GST Officials have the basic per unit price lists according to the HSN CODE which they use for calculating the actual value of shipments. If any discrepancy is encountered related to alteration in tax payment while transiting the shipment, the officials have the authority to impose a penalty of 200% of the actual value of the shipment.

NOTE: If any E-Way Bill is tagged with any shipment once, it cannot be retrieved or untagged to use it further with any other shipment. Fresh E-Way Bill is to be generated every time when an order is manifested with the actual details in the invoice of the shipment.

BigShip’s Packaging SOP’s

Liquid Items

Packing an item involves leak proofing, cushioning, placing of the item and filling of the

voids

in the

box. Enough cushioning needs to be provided to ensure no loads are transferred to the item.

Material - Bubble Wrap & Foam sheets

Liquid Products

Liquid Products need to be made leak proof before cushioning or packing. Common leak

proofing techniques

are

mentioned below.

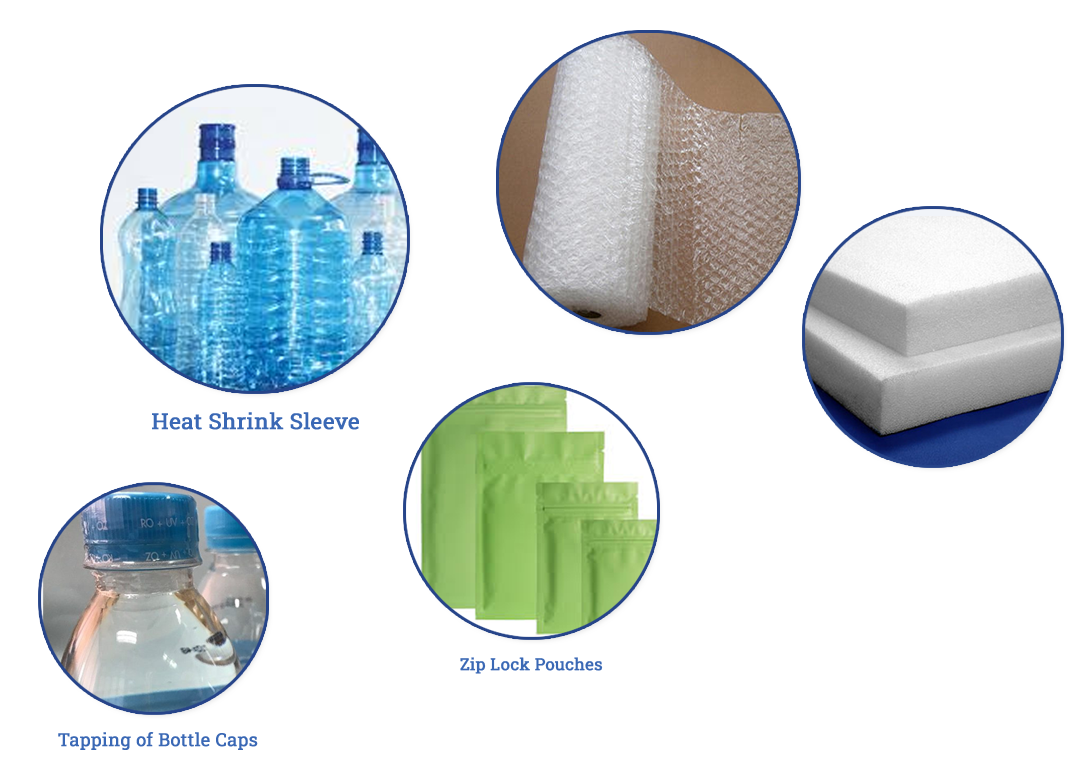

Material - Heat Shrink Sleeve / Tapping Of Bottle Caps / Zip Lock Pouches

Packaging Recommendations

- Check Strength / Load bearing capacity box (from manufacturer).

- Load bearing box should be greater than total weight of product going inside.

Recommendation

| Recommendation | Packaging Recommendation | Box Specification |

|---|---|---|

| Up to 4 Kg | 3-Ply Corrugated Box | Material specification to be decided as per strength required & weight inside box |

| 4–25 Kg | 5-Ply Corrugated Box | |

| Above 25 Kg | 7-Ply Corrugated Box | |

| Tools & machinery | Corrugated box covered with wooden frame or wooden box |

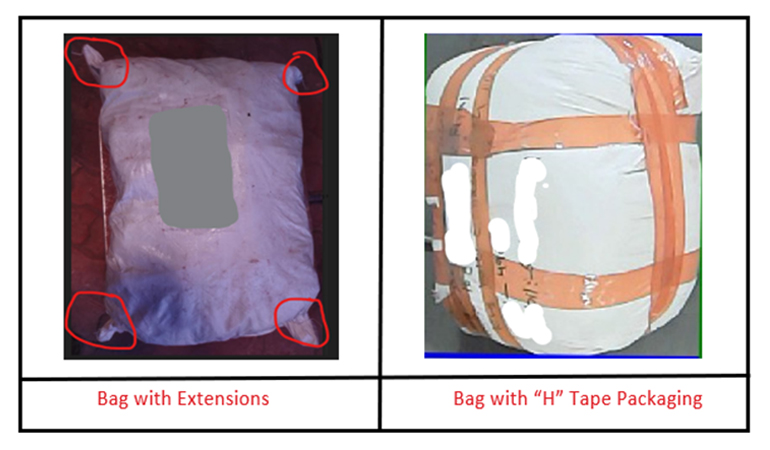

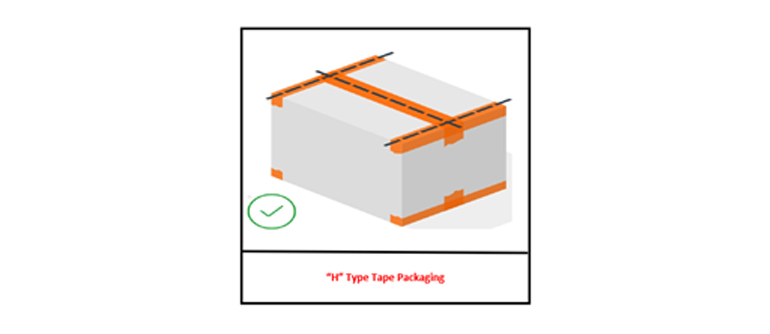

NOTE: If the seller is using Gunny Bags for packaging the shipment, it must be packed properly and its edges to be attached in a way that no extensions should be left. Leaving extensions in the Gunny Bags could result in more volumetric weight and overweight discrepancy afterwards. It is recommended better to “H” pack the bags using the adhesive tape.

Heavy Tools/ Equipment-Packaging Procedure

Primary Packaging

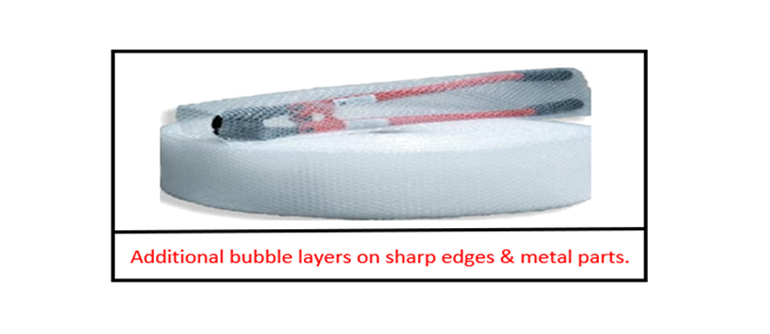

Pack the product in primary box if available, In case of no primary packaging, wrap the product in 3 layers of bubble wrap & tape it

Secondary Packaging

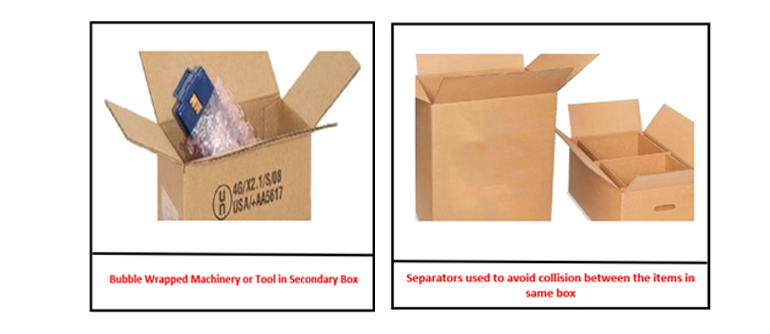

- Put them inside appropriate secondary box.

- Use separators, if required.(Select secondary box depending on load inside)

- Wooden pallet box can also be used for very heavy tools/ equipment.

- If any space is left inside secondary box, put enough filler so that primary boxes do not move in transit

- Close the box & tape it. ”H-Taping is recommended on both sides.

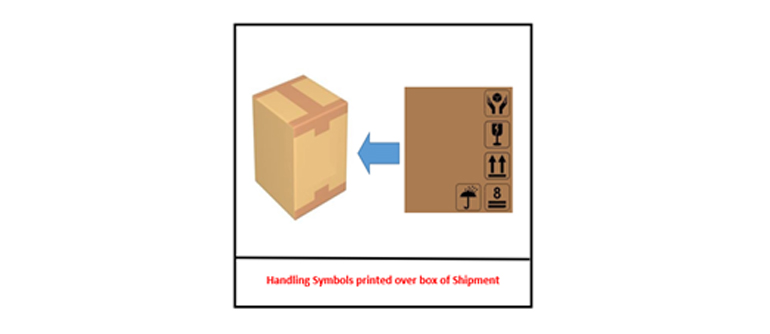

- All necessary handling symbol should be mentioned on the secondary box.

- Strap box for easy handling put edge protector on the stress points in box.

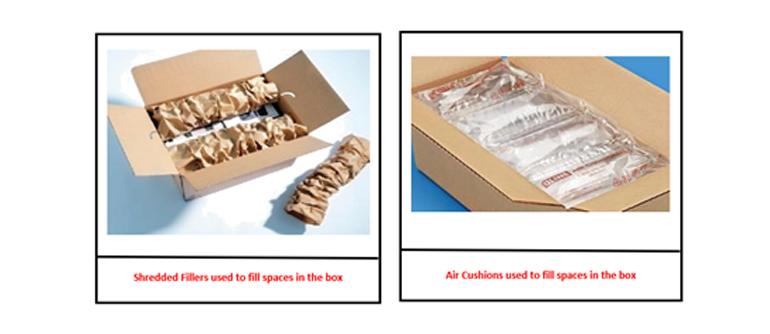

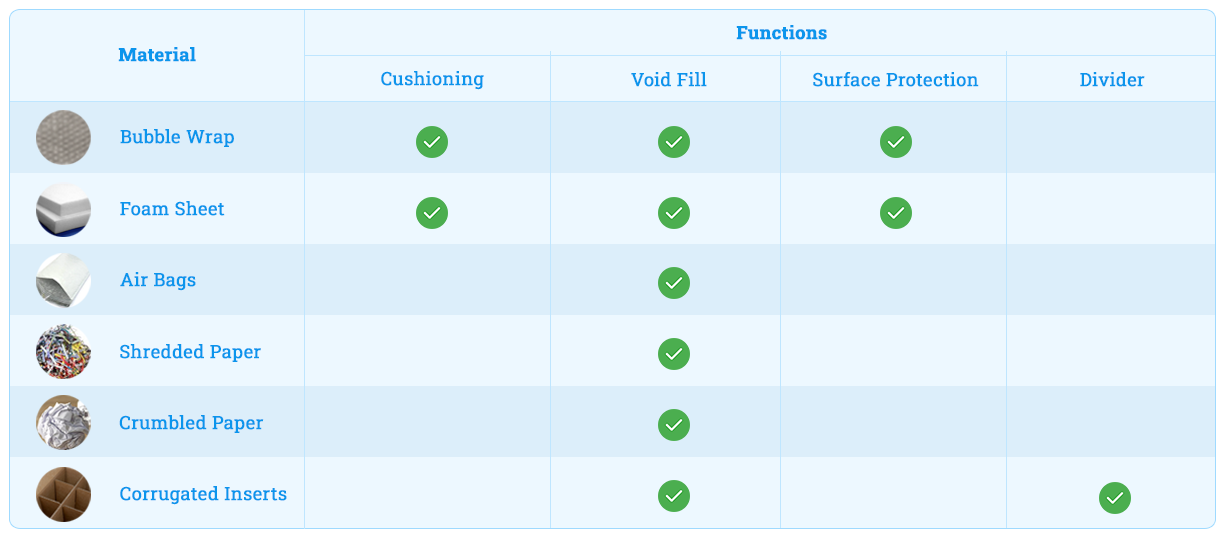

BigShip’s Internal Packing Material

Packaging Multiple Products SOP

Taping multiple package products under one shipment type is against the packaging practices. If you have multiple bags/ cartons- ship them under different AWB numbers (as different products) or use our Multi- package shipment facility. All packages must have AWB number label sticked on them properly. No claims for loss or damage will be entertained in such a case.

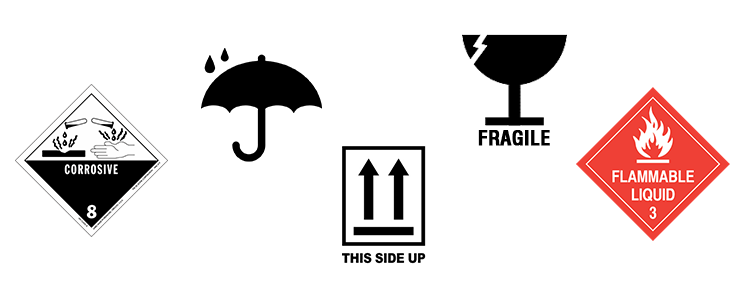

Bigship’s Special Handling Labels

Special handling labels helps in communicating the necessary information for appropriately handling the Shipment.

Common Categories

- Fragile

- Perishables

- Dangerous Goods

- Package Orientation

- Keep Dry

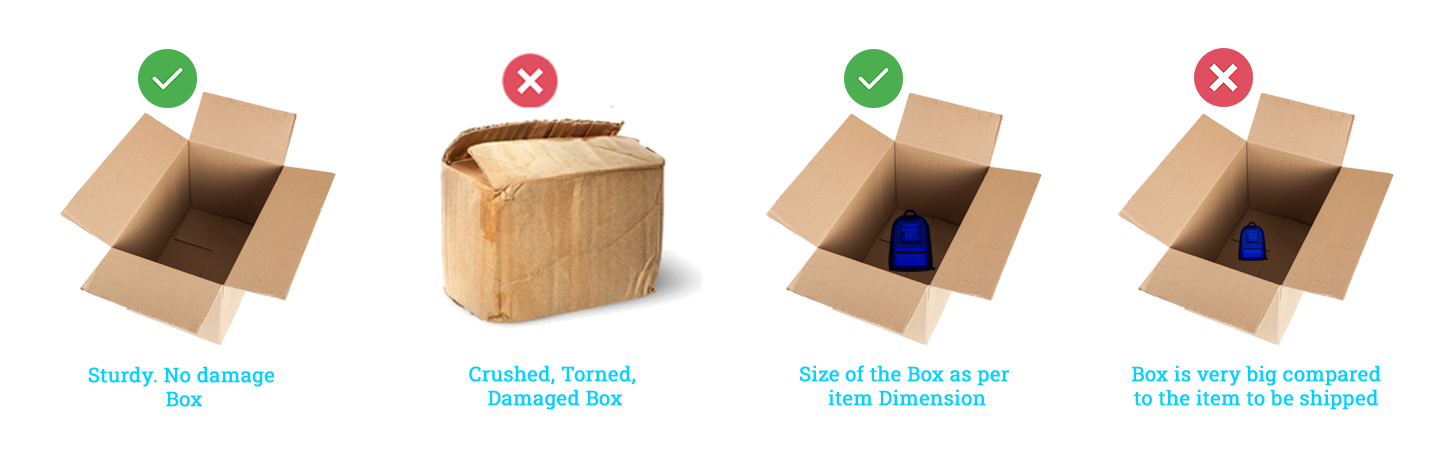

Quick Check

Inspect the box for holes, tears, crushed edges and sturdiness. Avoid poor quality boxes for the safety of the item shipped.

Material

- Use corrugated boxes of 3 ply for products below 4Kg and not fragile.

- Use corrugated boxes of 5 ply for products above 4Kg and fragile.

- Use tamper evident boxes for high value items (Cost above Rs. 7000).

- Ensure the material used can withstand the required edgecrush and burst factor loads.

Quick Check

- Optimize the size of the boxes as per the product dimensions

- The box should not be too small or too big for the item shipped. An optimum size box should be chosen

- Inspect the box for holes, tears, crushed edges and sturdiness. Avoid poor quality boxes for the safety of the item shipped.

List of prohibited or restricted items

| Restricted Items | Restricted Items |

|---|---|

| Live or dead animals | Drugs/Tobacco/Alcohol/Betel Nut Products |

| Illegal narcotic substances | Firearms (including parts) and Ammunition |

| Fake/dummy/game/toy weapons, paint ball | Guns, BB guns, antique weapons, swords, knives etc. |

| Items that could be used as weapons decorative swords, kitchen, knives etc.) | Human remains (including ashes) |

| Furs and skins (untreated) | Indecent goods & pornography |

| Any noxious substance | Plants/Seeds |

| Bullion | Cash or Currency |

| Payment cards, traveller cheques, etc. | Jewellery |

| Precious metals & stones | Works of Art |

| Antiques | Items of a fragile nature |

| Packages that are wet, leaking or emit any | Foodstuff & Perishable goods |

| Any inadequately packaged item | Corrosive Materials (Acid, Bases & Chemicals in Any Form) |

| Glue & Adhesive products (containing flammable liquid or quick drying) | Aerosol cans (e.g. Hair spray, Deodarants, Insecticides) |

| Alarm devices (gas or battery powered) | Appliances & Electronic Items (containing batteries) |

| Asbestos | Batteries (contained in any appliance, made of lithium or Dry/Wet cell & battery fluids) |

| Blasting caps | Bleach |

| Vehicular Fluids (Brake fluid, Engine Oil, Fuel,etc) | Fire lighter & Flint Lighters & Cigarette lighters |

| Firearms | Fireworks (e.g. Skyrockets, sparklers, crackers) |

| Flammable liquids and flammable solids (e.g. Perfume) | Gas (e.g. Propane, butane, hydrogen, helium, camping gas, cylinder full or empty) |

| Camphor | Disinfectants |

| Dyes | Essential oils (e.g. Eucalyptus, tea tree) |

| Varnish (e.g. Removers, thinners) | Fertilizers |

| Fire extinguishers | Opium Derivative Drugs (Codeine, Morphine,Heroin,Oxycodone,Etc) |

| Any item whose carriage is prohibited by any law, statute or regulations of the state/country of origin or destination, or of any state/country through which the shipment may transit. | |

| Radioactive Material | Counterfeit goods or fake items |

| Marble items, Cermic items | |